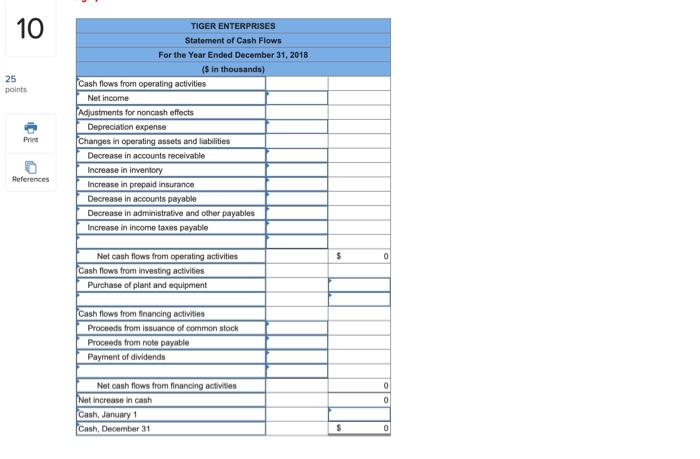

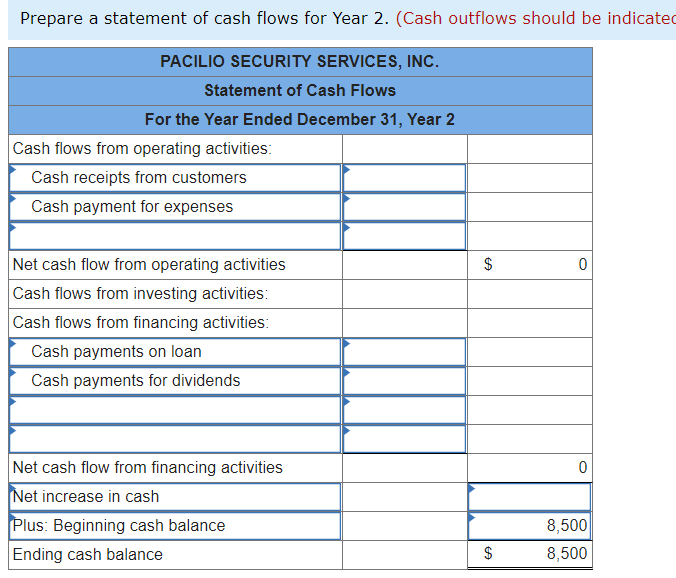

Under IAS 7, cash flows are classified into operating, investing and financing activities in a manner which is most appropriate to its business (IAS 7.10-11). The statement of cash flows is required to be presented by all entities for each period for which financial statements are presented. If there is any foreign exchange gain or loss a reconciliation statement to be prepared reconciling the Cash and Cash equivalents balances, as there is no inflow or outflow of cash….Statement of cash flows presents inflows and outflows of cash and cash equivalents and is dealt with in IAS 7. If the Securities Premium a/c balance has decreased compared to previous year then you should not add these expenses….Īny extraordinary items should be shown under appropriate activity separately. Verify whether such expenses had been written off against the securities premium available. If you assume them as current liabilities then you should show these under Working Capital Changes…. You will add Provision for dividend and Provision for tax only when they are Non-Current Liabilities.

Opening balance of cash and cash equivalentsĬlosing Balance of Cash and Cash equivalents Net Cash received/paid during the year (A) + (B) +(C) Now you will arrive at “Net Cash from Financing Activities”.

Now you will arrive at “Net Cash from Operating Activities”. (should be shown at the end because of its nature)

Any foreign exchange loss (since non – cash item).Depreciation provided during the year (since non – cash item).Loss on sale of fixed assets/ long term investments (since non – operating expenses).Any miscellaneous expenditure written off during the year (preliminary expenses, premium on redemption etc.).Then you will arrive at net profit before taxes.

#Preparation of the statement of cashflows how to

How to arrive at net profit before taxes:ĭifference between P&L a/c balances of two years in the B/S While starting with operating activities, you will consider Net profit before taxes. Preparation of Cash Flow Statement (Indirect Method): anyhow while preparing cash flows from Investing and Financing you will add any receipts and deduct any payments directly. In direct method, you will directly consider cash related items and exclude any non-cash items while arriving at cash from Operating Activities.

The only difference between direct and indirect method is procedure of arriving at cash from Operating Activities. Preparation of Cash Flow Statement (Direct Method): Receipts from issue of equity shares, preference shares, loans, debentures etc.Redemption of preference share capital and debentures.Loans and advances to third parties etc.Ĭash from Financing Activities include cash flows which result from change in the capital and borrowings of the company….Payments for acquisition of long term investments and assets.Receipts from sale of long term assets and investments.Commissions and royalties received etc.Ĭash from Investing Activities include cash flows from long term investments and sale or acquisition or generation (Capital work-in-progress) of long term assets.Payments for purchase of goods and services.cash generated in the normal course of business…. Our work is to classify those inflows and outflows into three activities namely operating, investing and financing activities.Ĭash from Operating Activities include cash generated from production and related activities i.e. Cash Flow Statement….As the name itself indicates the statement which only deals with inflow and outflow of cash (and cash equivalents) during the accounting year.

0 kommentar(er)

0 kommentar(er)